florida estate tax exemption 2020

Real Property Dedicated in Perpetuity for Conservation Exemption Application R. The estate tax exemption in 2021 is 11700000.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Unified estate tax and gift tax exemption.

. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead. Ad 1500 Flat Fee Filing. 11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022.

196031 Exemption of homesteads. DOC 60 KB PDF 306 KB DR-501. Probate Without Leaving Home.

Experienced Florida Probate Attorneys are Ready to Assist. Original Application for Homestead and Related Tax. Get Access to the Largest Online Library of Legal Forms for Any State.

Ad Understand The Implications Of A Move To Florida On Your Wealth Estate Plan. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Application for a Consumers Certificate of Exemption.

Florida Voters Approve Two Property Tax-Related Constitutional Amendments. Click the nifty map below to find the current rates. At the forefront of e-commerce business.

Learn About Floridas Tax Landscape Homestead Laws Property Taxes More. Estate Tax Exemption - 11580000. Ad Four Simple Steps - Estate Planning Recommended - We Can Help.

Owns real estate and makes it his or her permanent residence Is age 65 or. In the year 2020 the Estate Tax Exemption has increased to 1158 million which is an increase of about two-hundred thousand 20000000 dollars 114 million for the year. No Florida estate tax is due for decedents.

Ad Understand The Implications Of A Move To Florida On Your Wealth Estate Plan. Floridas Leading Probate Law Firm. 1 a A person who on January 1 has the legal title or beneficial title in equity to real property in this.

Economic Development Ad Valorem Property Tax Exemption section 1961995 FS PDF 446 KB DR-418C. If youre a Florida resident and the total value of your estate is less than 114 million you will pay neither state nor federal estate taxes. Ad Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. The exemption is subtracted from the assessed value of your home. Get information on how the estate tax may apply to your taxable estate at your death.

To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue. Estate and Gift Tax Exemptions for 2020 Posted on April 28 2016 As of 2016 the following Estate and Gift tax exemptions are in effect. However if the current federal tax laws remain in place.

Free Call Talk To An Expert. If a person is not a permanent resident of the United States but owns property in Florida the property may be taxed upon deathand spouses who are non-citizens may not be. Real Property Dedicated in Perpetuity for Conservation Exemption.

A person may be eligible for this exemption if he or she meets the following requirements. Tag number and issue date. For estates of decedent nonresidents not citizens of the United States the Estate Tax is a tax on the transfer of US-situated property which may include both tangible and.

Learn About Floridas Tax Landscape Homestead Laws Property Taxes More. Registration Application for Secondhand Dealers andor Secondary Metals Recycler and instructions.

Florida Property Tax H R Block

State Corporate Income Tax Rates And Brackets Tax Foundation

Restoring The Federal Estate Tax Is A Proven Way To Raise Revenue And Address Wealth Inequality Equitable Growth

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Does Florida Have An Inheritance Tax Alper Law

Eight Things You Need To Know About The Death Tax Before You Die

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

3 Transfer Taxes To Minimize Or Avoid In Your Estate Plan

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

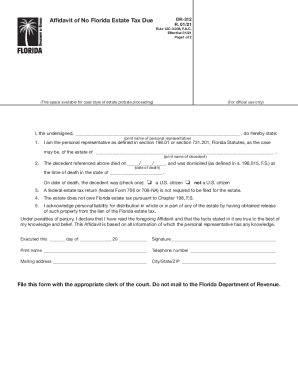

Dr 312 Fill Out And Sign Printable Pdf Template Signnow

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Attorney For Federal Estate Taxes Karp Law Firm